Bitcoin halving is an important economic phenomenon that occurs every four years and cuts the reward for Bitcoin mining in half. This mechanism was designed by Bitcoin founder Satoshi Nakamoto to simulate the scarcity of precious metals, ensuring the limited supply of Bitcoin and the stability of the currency's value. Halving not only affects Bitcoin's inflation rate, but also has a profound impact on mining behavior, miners' earnings, and the entire Bitcoin economy.

History of Bitcoin Halving

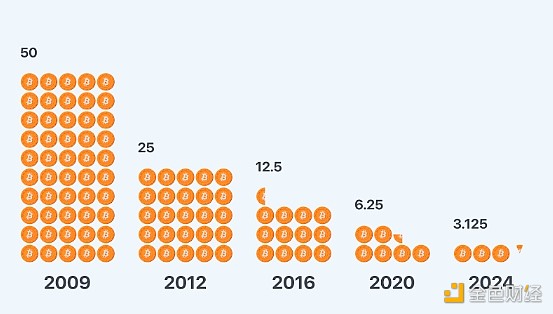

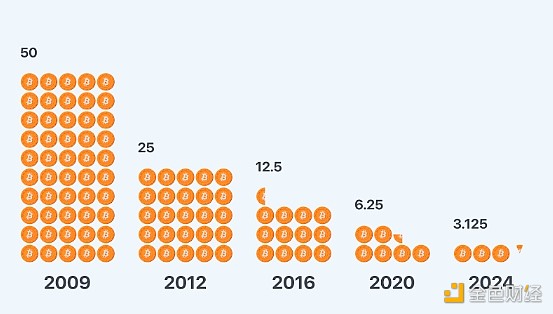

The history of Bitcoin halving can be traced back to the first halving in 2012, when the block reward was reduced from 50 Bitcoin to 25 Bitcoin. Subsequently, in 2016 and 2020, the reward was reduced to 12.5 and 6.25 Bitcoin, respectively. The next halving is expected to occur on April 20, 2024, when the reward will drop to 3.125 bitcoins. This process will continue until the maximum supply of bitcoin is reached, 21 million, which is expected to be completed around 2140.

After the halving, the inflation rate of Bitcoin will be half that of gold

Halving has a significant impact on the inflation rate of Bitcoin. After each halving, the rate at which new bitcoins are generated slows down, and the inflation rate also decreases. For example, after the first halving, the inflation rate dropped from about 25% to 11.78%; after the second halving, it dropped from 8.34% to 4.09%; after the third halving, the inflation rate dropped further to 1.77%. After the fourth halving, the inflation rate is expected to drop to 0.85%, which makes Bitcoin's inflation rate expected to be about half that of gold, highlighting the scarcity of Bitcoin.

Bitcoin inflation rate over time

Bitcoin inflation rate over time

The impact of halving on the market

For miners, halving is a challenging period. Although the reduction in block rewards means a halving of revenue, the historical increase in Bitcoin prices has often been able to compensate for this loss. Halving has prompted miners to seek more efficient mining methods and promoted innovation in mining technology. At the same time, the halving also reinforces the contrast between Bitcoin and traditional fiat currencies, which may face the risk of inflation and devaluation due to unlimited printing by governments.

Bitcoin halving also has an important impact on market dynamics. Historical data shows that Bitcoin prices tend to fluctuate significantly before and after halving. Market participants usually expect that the reduction in supply will lead to price increases, thus pushing up prices before the halving. After the halving, although there may be price fluctuations in the short term, in the long run, Bitcoin's deflationary nature and limited supply make it an attractive asset, and Bitcoin usually experiences significant bull runs.

Price changes before and after the first three halvings

In short, Bitcoin halving is a key mechanism in the Bitcoin economic model, which maintains the scarcity and value stability of the currency by slowing down the generation of new coins. This event not only affects the income and mining behavior of miners, but also has a profound impact on the market performance and economic model of Bitcoin. As halving events continue to occur in the future, the deflationary nature of Bitcoin will be further revealed, and its status as digital gold will be further consolidated.

With the approval of the US Bitcoin spot ETF and the approaching halving narrative, the cryptocurrency market is ushering in unprecedented attention and development opportunities, and a violent bull market is about to come. As the world's leading trading platform and the global partner of the Argentine national football team, 4E platform has always been committed to providing a stable and efficient trading experience to ensure that users can trade smoothly in this bull market and enjoy a deep market and optimized services. Welcome to choose 4E platform and share the cryptocurrency investment feast!

Kikyo

Kikyo