Author: Aylo, author of alpha please; Translation: Golden Finance xiaozou

Following the last hugely successful Jito airdrop (with a peak value of over 450 million US dollars), the JUP airdrop is coming soon. JUP is the token of Jupiter, and Jupiter is a token on Solana. Key DeFi aggregation platform.

This airdrop is scheduled to start on January 31st and is the most anticipated airdrop in the history of Solana.

What makes Jupiter unique? Will JUP deliver on its promise? At what price should we sell? Or when should we buy more?

In this article, I will take you in-depth understanding of everything about the Jupiter product line, future plans and potential opportunities for JUP airdrops.

1. Jupiter: One-stop DeFi store on Solana

Since October 2021 Since its launch in March, Jupiter has been striving to create the best decentralized trading experience on Solana. The platform achieves this vision by aggregating various DeFi features into one application to provide the most seamless and smooth user experience.

While Jupiter was originally conceived as a swap engine, the protocol has evolved significantly to provide a variety of different products for different types of users, including: Dollar Cost Averaging (DCA), Limit Orders, Perpetual Contracts trading, and more recently the launch platform.

In my opinion, DCA tools may be the best products in DeFi currently.

p>

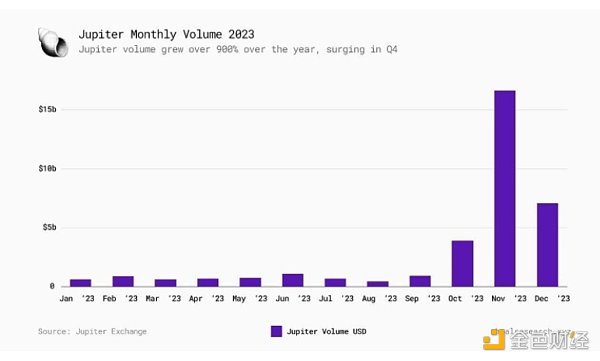

Jupiter's growth in 2023 has been outstanding, with monthly trading volume soaring about 10 times - from $650 million in January to $7.1 billion in December. Notably, following the announcement of the JUP token, monthly trading volume exceeded $16 billion in November, setting an all-time high.

p>

In 2023, Uniswap's monthly trading volume will be as low as US$17.4 billion and as high as more than US$70 billion.

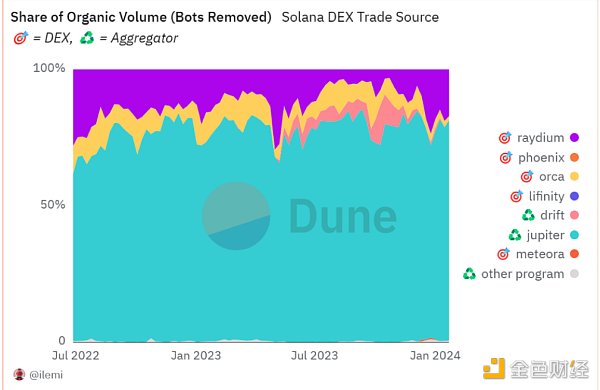

Currently, Jupiter's transaction volume exceeds 66.5 billion US dollars and handles more than 1.2 million transactions, making it a key layer of the Solana ecosystem. It accounts for more than 70% of Solana's DEX organic trading volume, making it a trusted reference platform for Solana retail traders.

p>

Despite this, Jupiter continues to innovate, improve existing features and launch new products based on its three main business models:

Provide the best user experience

Maximize Solana’s technical capabilities

Improve Solana’s overall Liquidity

Given its unique positioning, I believe Jupiter is betting on the following two things:

Long-term Solana Adoption: The Solana Network in 2023 Activities increased and it was a year of rebirth for Solana. I believe Solana has the ability to continue to grow and capture a larger share of the L1 market. This will be beneficial to Jupiter.

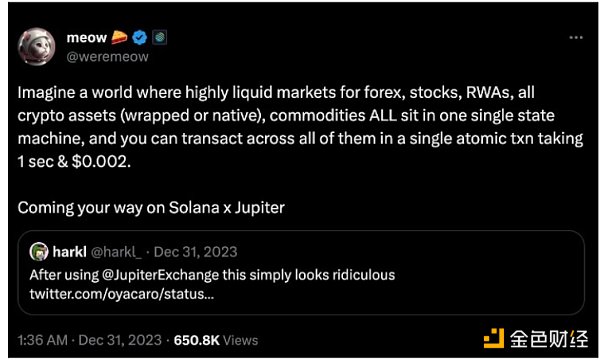

DeFi will become mainstream: the future of trading is on the chain, even the CEO of large traditional financial institutions like Larry Fink Officials are also starting to talk about “the tokenization of every financial asset.” So it seems reasonable to think that Jupiter can facilitate this transformation.

The recently announced JUP token further reflects Jupiter’s strategic measures in this direction.

2. JUP: DeFi 2.0 symbol

JUP token marks the development of Jupiter and an important spiritual milestone. Just as Uniswap’s governance token UNI symbolized the first wave of DeFi on Ethereum, JUP aspires to embody the essence of DeFi 2.0 on Solana.

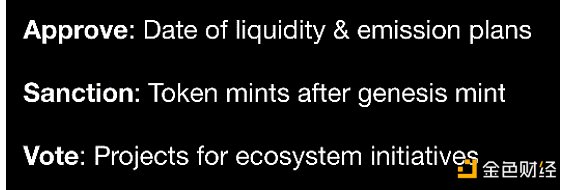

As a governance token, JUP will allow holders to influence key aspects that determine the ecosystem, including voting on key aspects of the token itself, e.g. Timing of initial liquidity provision, future distribution releases, and important ecosystem initiatives.

p>

The main goal of the token is:

< li>Inject vitality into the Solana ecosystem by attracting new capital flows and users.

Create momentum for the launch of new ecosystem tokens: JUP will be a catalyst for the launch of more ecosystem tokens.

Build a powerful distributed JUP community.

As anonymous co-founder Meow puts it, JUP aspires to build “the most effective, forward-looking, and The most decentralized, non-internally voted DAO”.

Furthermore, the utility of JUP will evolve over time and will depend on what direction the community takes. Potential uses for this token may include:

Reduce trading fees for perpetual futures contracts.

Optimize access to and distribution of publishing platforms.

Automated market maker (AMM) fee sharing.

However, Meow made it clear that they will not open the revenue sharing model until the user scale has expanded at least 10 times.

3. Token Economics

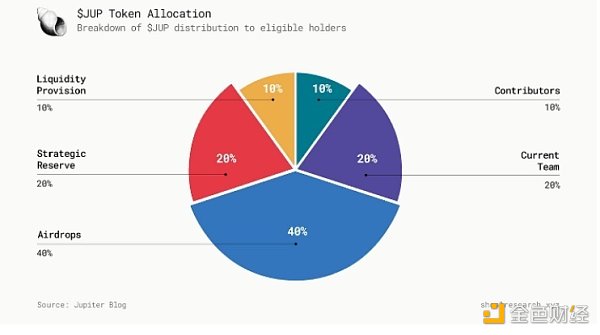

The token economics of a project will reflect the The spirit of the project, and Jupiter's vision is to make it as simple as possible. With a maximum supply of 10 billion JUPs, the tokens are evenly distributed between two cold wallets - the team wallet and the community wallet. The team wallet will be used for the current team, treasury, and liquidity supply distribution, while the community wallet is for airdrops and various early contributors.

p>

4. Airdrop details

The first round of airdrop is scheduled to be held on January 31st. Distribute 10% of the total supply to the community. The details of the airdrop are as follows:

All Average wallet distribution (2%): 200 million tokens will be distributed equally to all users who have used Jupiter before November 2, 2023, equivalent to approximately 200 JUP per user.

Graded score distribution, the score is based on the unadjusted quota (7%): the specific distribution is roughly as follows:

Level 1 allocation: The first 2,000 users will be allocated 100,000 tokens each (estimated transaction volume exceeds 1 million)

< p style="text-align: left;">Secondary distribution: The next 10,000 users will be allocated 20,000 tokens each (estimated transaction volume exceeds 100,000)

Third-level distribution: The next 50,000 users will be allocated 3,000 tokens each (the estimated transaction volume exceeds 10,000)

Four-level distribution: The next 150,000 users will be allocated 1,000 tokens each (the estimated transaction volume exceeds 1,000)

There will be three rounds of airdrops in the future.

5. JUP token valuation — Comparison with JTO

New A common problem with airdrops is determining the fair value of the token.

Although there is no direct answer to this question of JUP, one possible method is to conduct a comparative analysis with the recent airdrop on Solana, that is, with the JTO token. Coin comparison.

JTO is the governance token of Jito Lab, a liquidity staking platform built on Solana. The airdrop distributed 10% of the JTO supply to approximately 10,000 users. The amount of airdrops once exceeded $450 million.

JTO Price Analysis

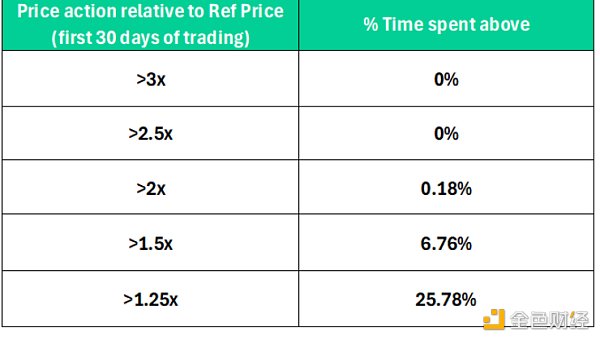

Use Binance First Quote ( After the initial market volatility) at a reference price (Ref Price) of $2.13, this is the approximate price trend after the release of JTO:

The following are some trends reflected in the table :

Initially, in the first During the trading day, the token price fluctuated significantly, rising from $1.74 to $3.77. Furthermore, the trading price was higher than the initial quote of $2.13 83% of the time.

In addition, it is worth noting that the first week of trading is indeed good for JTO. The coin traded above its reference price 97% of the time, reaching an all-time high (ATH) of $4.45.

Now looking at the percentage of time occupied by different price areas, we can see that JTO did not occupy too much time at the historical highs. For a long time, it exceeded the reference price of $2.13 by more than 2 times only 18% of the time.

p>

In addition, we also see that compared with the first quotation, the price of JTO has not fallen by more than half. Furthermore, it only fell by more than 25% about 8.6% of the time.

p>

Although the price trend of JUP is not necessarily consistent with the trend of JTO, you can make some assumptions:

JUP is expected to be highly volatile on its first trading day, potentially providing opportunities for short-term traders.

The launch of JUP is likely to generate great excitement, likely to reach a local peak in the first week of trading, with prices rapidly A rise, more than twice the initial offer, could also mean it's time to sell.

Conversely, a drop of more than 50% from the initial quote may be considered a buying opportunity.

6. "Overbought" indicator — JTO FDV / LDO FDV ratio6. h2>

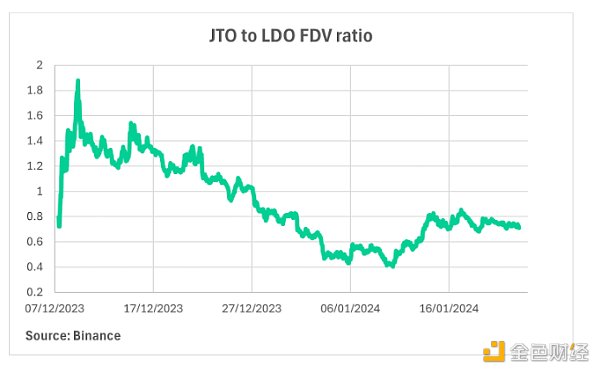

Jito is similar to the Lido protocol. The key difference between the two is that Jito runs on Solana, while Lido runs on Ethereum. Therefore, when JTO is released, a reasonable way to price the token is to observe the relationship between JTO's FDV (fully diluted valuation) and LDO (Lido governance token) FDV. This comparison allows us to gauge how the market is valuing JTO relative to similar offerings on Ethereum.

This is the JTO FDV / LDO FDV ratio since the release of JTO:

We observed that after the release of JTO, its FDV quickly became higher than LDO FDV, reaching a ratio of nearly 1.9, which is almost twice that of LDO FDV. However, this surge was likely driven by optimism, with the market quickly pulling JTO back to lower levels. In the following weeks, the FDV ratio of JTO to LDO showed a downward trend, falling to 0.4, and then rebounded strongly to around 0.7-0.8. So far, the market seems to have finally settled on a fair value in this range, which is very close to the average of the past few months (0.9).

From this we can draw the conclusion that for JTO, a ratio exceeding 1.6 is a clear overbought signal, while 0.4 is a strong oversold Signal.

7. Apply this evaluation to JUP

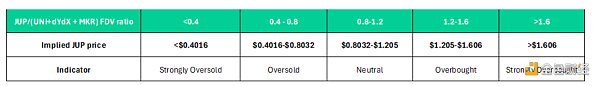

Just like LDO corresponds to JTO, we It is also necessary to find a comparison anchor for JUP on Ethereum.

Given that Jupiter is the largest decentralized exchange (DEX) on Solana, with automatic market maker (AMM), DCA, perpetual contract trading and issuance Platform opportunities and other features, it is very challenging to find similar corresponding projects on Ethereum. Therefore, I think Uniswap, dYdX and DAO Maker combined are almost the closest to JUP. Therefore, their fully diluted valuations (FDV) can be used together for comparison. At the time of writing, the total FDV of their respective tokens (UNI, dYdX, and MKR) is approximately $10.04 billion.

We can use this comprehensive FDV value, as well as the key values of the JTO/LDO FDV ratio, to evaluate the JUP price under different circumstances.

p>

By using the same relative valuation analysis, we can derive these key price levels to further optimize airdrop decisions:

However, it is worth noting that JTO has a relatively high daily beta value of 0.86 relative to Solana. Therefore, JTO’s price action closely correlates with Solana’s, and JUP is likely to follow the same pattern.

At the time of writing, Solana is trading at $80-82, below the $120-130 level, which is a drop of more than 30%, indicating that the market The situation may not be as optimistic as it was during the JTO airdrop.

p>

When comparing the SOL price one month before the JTO airdrop with the recent SOL price, it is clear that market conditions have changed. Therefore, it seems reasonable to think that this could have a negative impact on the price of JUP.

8. Potential airdrop returns

Can the scale of this airdrop be as large as JTO? Let's analyze it together.

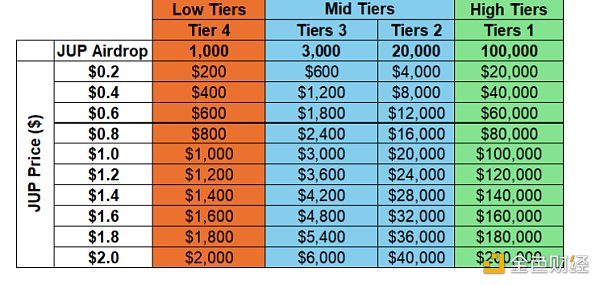

If we refer to the different returns of various levels of allocation, we can get the potential airdrop potential of JUP at a given price:

In contrast, this is the return of JTO under different grades and different key prices:

Even at the all-time low of $1.323 Under this circumstance, the size of JTO’s airdrops at all levels is also higher than the potential return of JUP’s airdrop (even when the JUP price is $2).

To put this into perspective, in order for JUP's lowest tranche to match JTO's lowest tranche return at its all-time low price, JUP would need to be trading above $20. This means that the FDV is $200 billion, which is completely unrealistic.

However, it must be emphasized that the JTO airdrop is only focused on 10,000 users, while JUP is distributing tokens to nearly 1 million users. This means that JTO will have many buyers who are waiting to enter the market, while JUP has a wide range of issuance, so there may not be many buyers at the beginning.

The market did not expect that JTO would eventually have such a high market value, and it seems that expectations for JUP are also very high, so this is also a key difference that should be considered. When everyone expects the same thing, it almost never happens.

So, while the JUP airdrop may not provide as substantial returns to individual users as the JTO airdrop, its broad impact on the larger user base makes it a One of the most significant airdrops on Solana to date.

It is very likely that we will see a significant increase in on-chain activity after the JUP airdrop. This will be an incentive for many, especially for degens, who are further down the risk curve and chasing higher returns with what they perceive to be "free money" from JUP is common behavior.

One final note is that SOL may also benefit from increasing buying pressure from JUP profitable users, but it is clear that the market is The short term is far less optimistic, so it's difficult to gauge how SOL will perform over shorter periods of time.

Miyuki

Miyuki

Miyuki

Miyuki Alex

Alex JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Brian

Brian Cointelegraph

Cointelegraph Ftftx

Ftftx