Source: Blockchain Knight

February has become a bullish month for BTC prices as the price of BTC rose to $60,000 in the past day.

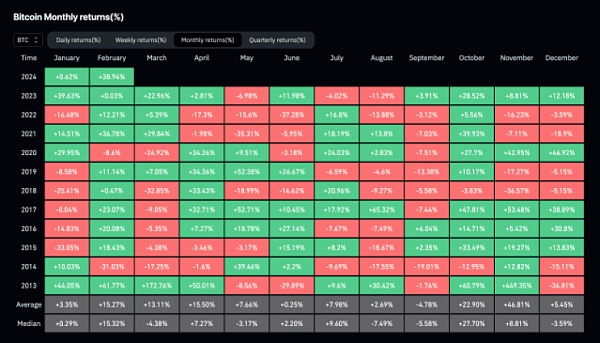

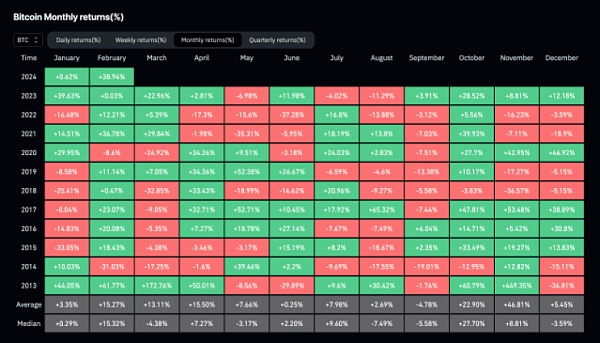

According to data from Coinglass, February was the second most profitable month in BTC history.

BTC had a very successful February, the best February for the Crypto asset in more than a decade.

Data from Coinglass shows that BTC prices have increased by approximately 39% this month. BTC prices are up approximately 39% this month compared to BTC’s performance in the same month over the past 10 years.

February 2013 still maintains the record for the highest return, with a return of 61.77% that month. Later, in February 2021, the monthly return reached 36.78%, ranking second until February 2024.

It is not unusual to end the month of February in green, though, as there have been more green closings than red closings in the month since BTC was launched.

Looking back at the historical years in which February ended in the green, we can chart the next direction of BTC prices.

Dating back to 2013, the excellent performance in February continued into March, resulting in March performance far exceeding February.

The return rate in March 2013 was as high as 172.76%. BTC’s performance throughout the year was impressive.

Similarly, in 2021, when February ended with high returns, this outperformance also continued into March, ending with a return of 20.84%.

Judging from the trends of these two months, February ended with high returns, which may indicate that the bull market rebound will continue here.

While BTC ended February with high returns and March was equally bullish, this was not always the case.

For example, between 2015 and 2019, February ended in green every year. However, only March 2019 continued the upward trend, and the BTC price in the remaining months showed varying degrees of decline.

However, February’s performance appears to have had an impact on March’s results. In terms of months with declining prices, the trend is that the better BTC performs in February, the better it performs in March.

Between 2015 and 2017, the average closing price at the end of February was +20%, while the highest decline the following month was 9%. However, when February ended with a weak gain of 0.47%, BTC fell by 32.85% in March.

Therefore, although March may become a red month for BTC, its excellent performance in February can serve as a buffer, making it easier for BTC prices to land.

JinseFinance

JinseFinance