Author: Jack Inabinet, Bankless; Translator: Tao Zhu, Golden Finance

Synthetic USD surges. Ethena's assets are being rapidly adopted in the crypto space! Why is it so urgent for protocols to integrate USDe, and what impact does integration have on token prices?

Given the extremely high yields generated by Ethena assets, sUSDe gets best-in-class returns in stablecoins through funding/staking payments, and USDe offers huge airdrop rewards, the demand for various types of financial products that can be synthesized from these assets is high, and users are willing to pay a premium to obtain them!

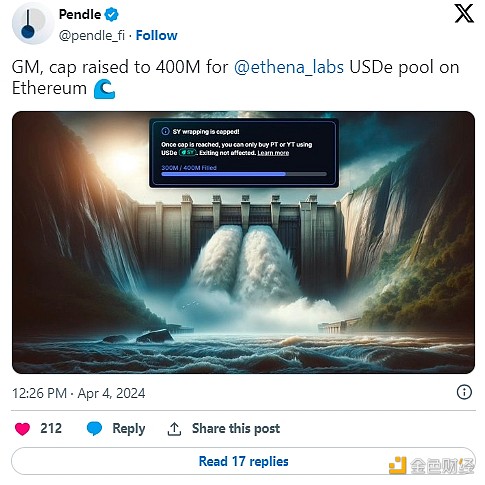

Pendle's total locked value (TVL) has increased by $800 million in the past week, with more than 40% of the growth attributed to USDe.

Pendle was instrumental in facilitating the Ethena airdrop, where those holding USDe protocol yield tokens (YT) purchase pure exposure to the points generated by the tokens in exchange for a fixed payment, with the strategy currently yielding 135 Sat per USD, with capital deployed daily with a single click.

Given the massive demand for the service, the potential for further expansion in deposits depends solely on Pendle’s willingness to raise the cap.

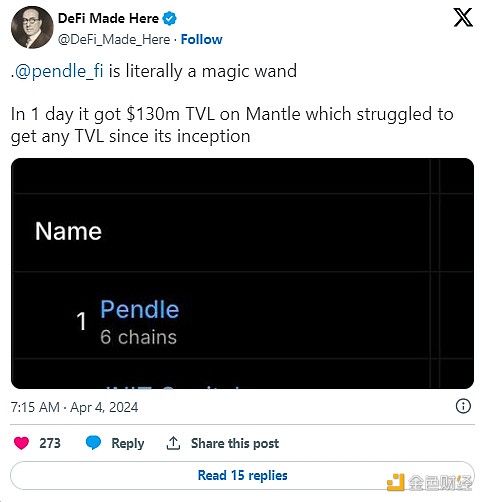

Mantle has laid the foundation for Pendle’s success, having recently received his own deployment of the protocol, which surged to $130M in TVL on day one and currently holds $160M in deposits.

To make itself the go-to for USDe credits through Pendle, Mantle is offering a daily reward of 0.0012 EigenLayer credits per USDe to its users who trade USDe YT and PT on-chain or provide liquidity, with 13.8 million credits up for grabs!

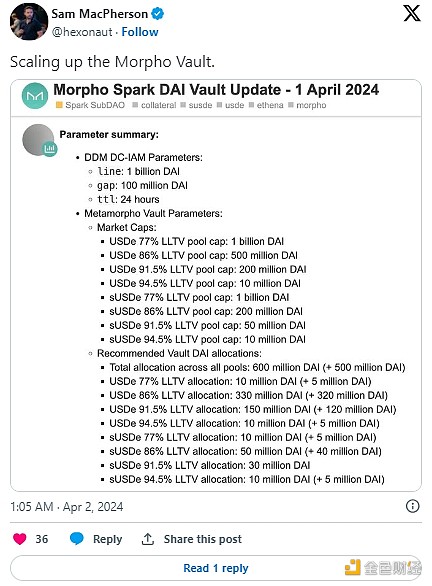

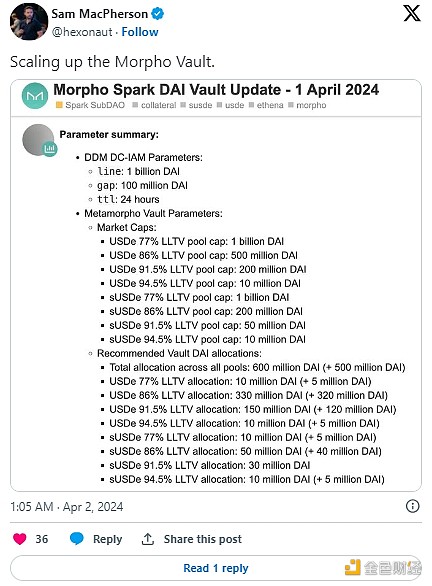

MakerDAO is also riding the Ethena wave, minting DAI with USDe and sUSDe collateral through Morpho. While only 2% of circulating DAI is collateralized by these Ethena lending operations, these loans have an annualized return of 66%, contributing 16% to Maker's expected revenue.

The facility is expected to expand to $600 million in the near future, with the potential to increase production lines to $1 billion, a move that will allow Maker to further increase revenue.

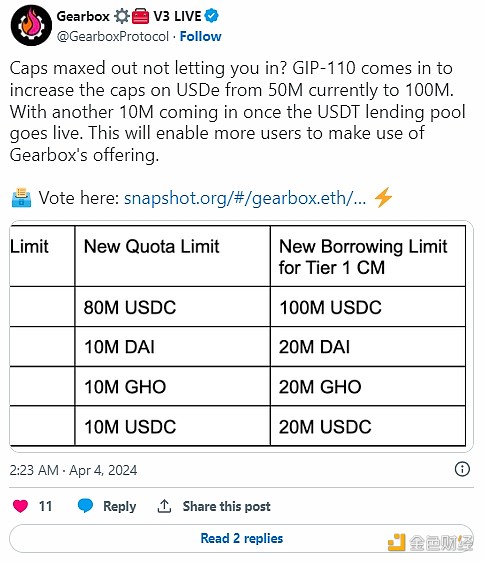

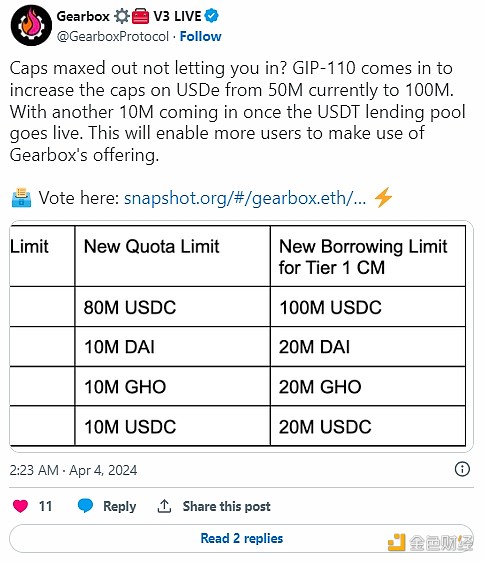

Gearbox is another protocol that allows degens to speculate on Ethena assets, allowing them to borrow the stablecoin to generate leveraged positions in USDe and sUSDe.

While the protocol doubled its USDe lending capacity from $50 million to $100 million yesterday, those limits were quickly reached, suggesting that as long as Gearbox is willing to raise the cap, they can expect to continue to grow deposits and revenue.

Despite growing concerns about Ethena’s long-term stability, integrating its assets seems to be the winning formula for now.

Compared to the 2.5% drop in the total cryptocurrency market capitalization over the past week, the tokens of the above protocols have seen double-digit gains, and user interest in Ethena’s products shows no signs of slowing down!

Financializing synthetic USD stablecoins to facilitate spot speculation certainly carries inherent risks. However, as deposits continue to rise, projects adopting them could see further gains.

JinseFinance

JinseFinance