Source: Liu Jiaolian

Tomorrow after tomorrow, how many tomorrows there are, waiting for tomorrow day by day, everything will be wasted.

Just when the bears are wasting time, BTC (Bitcoin) has been vigorous and high-spirited, crossing the 30-day moving average, re-occupying the 69k high ground, approaching the key psychological defense line of 70,000 dollars.

The "Art of War" by Sun Tzu says: Know yourself and know the enemy, and you will not be in danger in a hundred battles. Knowing yourself without knowing the enemy will lead to one victory and one defeat; knowing neither the enemy nor yourself will lead to danger in every battle.

When you come to a market, you don't know why you can make money, you can't say whose money you make, and you don't know why the opponent loses money to you, so you are in such a confused state, and you are likely to lose money.

When you come to a market, you know very well how to make money, but you don't know whose money you are making and what money you are making. Then, with your half-understanding state, you will have both losses and gains, and it is very good to barely break even without losses.

When you come to a market, you not only know very well how to make money, but also why you can make this money, what money you make, whose money you make, and who provides you with profits, and why they provide you with profits, then you will make money steadily.

The centralization of Grayscale's GBTC outflow event may be the straw that determines the balance of market forces.

In less than 15 days, that is, less than 2,000 blocks, Bitcoin will usher in another halving in history.

Jiaolian has discussed in a series of previous articles that the halving event is a neutral event in the long run and a pulse event in the short term.

First suppress and then rise, this is the cleverness of the halving event.

The closer the average output is to the halving event point, the more excessive it is, and the greater the preference given to the short side.

The sudden drop in output after the halving is just to compensate for the previous overproduction. But objectively, this has formed a bottom-line for the shorts.

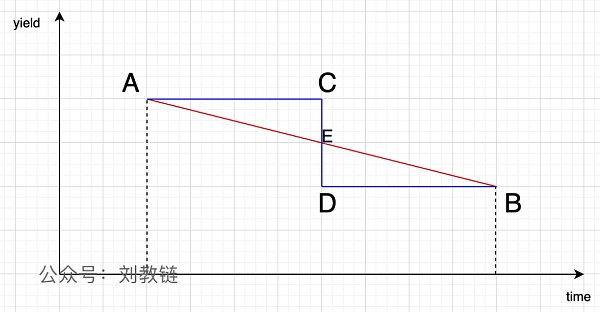

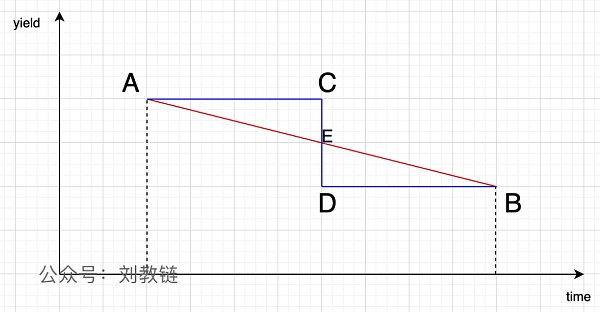

Jiaolian drew a schematic diagram as above. If BTC's production reduction follows a uniform decline, that is, the red straight line from A to B in the figure, then the selling pressure is uniformly weakened. We call this theoretical production.

But the design given by Satoshi Nakamoto is to take the blue broken line A-C-D-B. We call this actual production.

It can be clearly seen from the figure that the actual production in the first half of the cycle is the integral of AC, that is, the area from the bottom of AC to the horizontal axis. This is more than the theoretical production, that is, the integral area of AE, by the area of a triangle ACE.

The labor income of the long side, that is, the leeks who take over the market, is accumulated linearly. Salaries can only be paid month by month, and money can only be earned month by month. There will be no situation where wages or profits suddenly double every 4 years.

This means that the first half of the cycle was overproduced compared to the theoretical value, which handed over the excess bullets to the hands of the shorts, making them more powerful to suppress the long side.

Moreover, the closer it is to halving, the more and more excessive the actual output is compared to the theoretical output, the greater the advantage of the shorts' selling power over the longs' purchasing power, and the more arrogant the shorts are.

However, things change. No one side can always be in a dominant position without falling. No system allows one side to monopolize the power advantage and become stronger and stronger. If this imbalance cannot be regulated by negative feedback, it will eventually destroy the system.

The reasons behind the cyclical law of the governance, chaos, rise and fall of the feudal dynasties in ancient China for thousands of years are similar.

Bitcoin rebalances this imbalanced advantage by halving its output every four years.

When the event crosses the halving event point E, the offense and defense change, and the bulls suddenly gain the upper hand. The previous advantage of the bears is liquidated and turned into a huge disadvantage.

This is the dynamic reason why the halving event gives rise to the bull market pulse.

However, Bitcoin is not a halving event once, but 32 times.

As people's understanding and understanding of the halving event becomes more and more profound, the market will price this event earlier and earlier, thereby weakening the advantage gap between the bears and the bulls, and thus smoothing the cycle to a certain extent.

Qu Zi wrote Chu Sao in those days, holding a murderous knife in his hand.

Ai Xiao is too rich in pepper and orchids, and leaps towards the Wanli Wave.

JinseFinance

JinseFinance