Source: Blockchain Knight

The fourth day of U.S. spot BTC ETF trading has been completed, and the data is once again impressive.

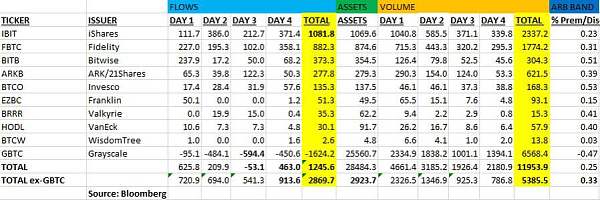

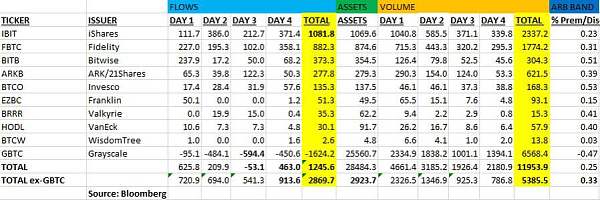

Bloomberg analyst Eric Balchunas releases final day 4 data for spot BTC ETFs via The strong performance of 10 approved ETFsThese ETFs are collectively referred to as the "New Nine".

Balchunas spoke of the rapid and huge success of these ETFs, saying: "The fourth day was good, with rolling net flows growing to $1.2 billion after the nine nascent funds took in $914 billion on Wednesday. This is the best day yet, surpassing GBTC’s $450. The current ‘nine’ have taken in $3 billion in the first four days, with transaction volume reaching $5.4 billion (unusually high).”

This investment boom particularly favors BlackRock’s IBIT, which has now accumulated more than $1 billion, followed closely by Fidelity’s FBTC and Bitwise’s BITB.

p>

However, the strong growth of these ETFs does not entirely mean that funds are moving away from Grayscale’s GBTC.

Balchunas elaborated: “Even if every penny of GBTC outflows went to them (which is not the case), this would be normal.For decades, ETFs have been moving away from high-cost common Money was drawn into the fund, and that still helped the ETF grow and acquire the magic that attracted millions of new investments."

"So get used to this model, '9 It’s not just GBTC that the snakehead wants to steal, anything with a high cost is fragile now, that’s the reality.”

Specific questions about IBIT’s inflows exceeding its trading volume on the fourth day , Balchunas said: “Some large-scale custom creation issues have emerged, indicating that there may be large transactions from institutional investors.”

The success of these spot BTC ETFs is not limited to their own fields. Balchunas pointed out that four days after official approval, two of them entered the top five and three of the most successful ETFs.

Only IVV, QQQ and VOO accumulated higher AUM in the first week.

p>

Samsung Research Director Alex Thorn confirmed that Grayscale’s GBTC selling pressure has decreased.

He reported earlier today: “This morning, Grayscale transferred 9839 BTC to Coinbase Prime to settle yesterday’s redemption (T+1 settlement).”

Notably, this is shorter than the day before when Grayscale moved 18,000 BTC (worth $770 million) to Coinbase Prime to resolve BTC redemption issues on Tuesday.

This observation is crucial considering that Grayscale has seen significant outflows from its GBTC since regulatory approval, which removes the discount to NAV and what competing ETFs offer Caused by factors such as lower costs.

However, it remains to be seen whether GBTC sales will indeed continue to slow down in the coming days and weeks. While inflows into other spot BTC ETF issuers (i.e. the “fresh nine”) have more than made up for the sell-off, BTC price has remained somewhat stagnant, hovering below $43,000 over the past few days.

At the same time, Crypto asset analyst James Van Straten made a sharp contrast between the speed of BlackRock’s IBIT acquiring BTC and Grayscale’s outflow speed.

He said: “This is crazy. At the current pace, in 37 days, IBIT will surpass GBTC in terms of BTC holdings. BlackRock will hold About 250,000 BTC, exceeding Grayscale’s estimate of about 240,000 BTC.”

JinseFinance

JinseFinance