Source: Biteye

01 Introduction

Mode Network is a modular Layer 2 based on OP Stack focusing on the Defi track. It adopts Optimism’s Bedrock upgrade and can reduce costs by more than 95% compared to the Ethereum main network.

The project received a $5.3 million donation from the Optimism Foundation in January 2024 (issued in the form of op tokens), and Mode will also transfer part of The income from the sequencer is donated to Optimism Collective, and Mode maintains a good relationship with the Optimism Foundation, which is beneficial to project development.

02 Development status

Steady growth, TVL at the forefront

Mode will be launched on the mainnet on January 31, 2024, and points airdrops will begin in February.

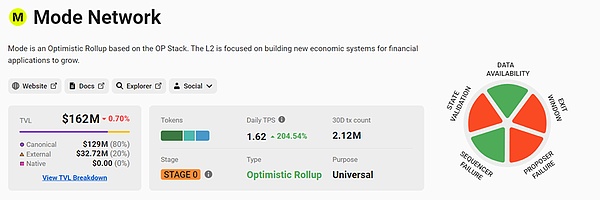

TVL has been Steady growth, as of March 19, 2024, TVL ranked 13th among all Layer 2 networks, at US$162 million, with an average daily tps of 1.62, and a median GAS of 0.001Gwei, which translates into actual cost of less than US$0.01. In the past thirty years A total of 2.12 million transactions occurred on a daily basis.

When the airdrop is in progress, interactive guide

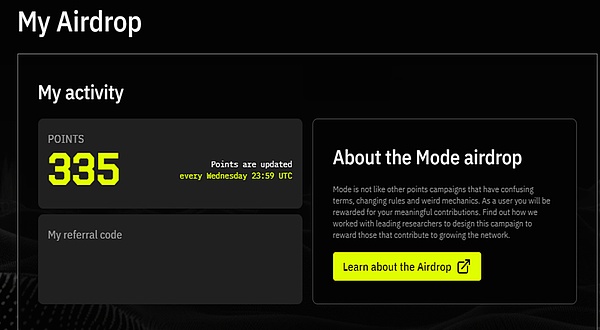

The total amount of Mode tokens is 100 billion, of which 5.5% will be used for airdrops. The specific token economics have not yet been released.

Mode started airdropping points in February and is expected to issue tokens in April. Users can obtain airdrop tokens by accumulating points. Participate now and get benefits in less than a month.

There are currently three ways to obtain points:

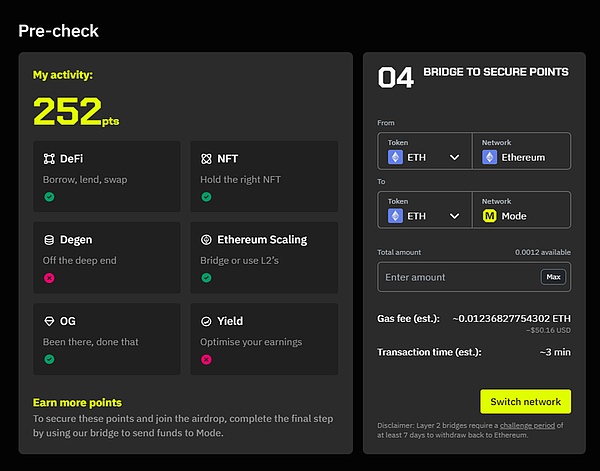

Rewards for old users. When Web3 old users use the wallet connection, they will obtain certain initial points based on their original blockchain interaction records. Through some cross-chain assets ( There is no requirement for the amount) to activate the points;

New rewards, users can get their own exclusive invitation codes after activating the points , the inviter will receive 16% of the points reward of the invitation code user;

Ecological interaction reward, interactive Mode ecological applications can also receive points , different types of projects will receive different point rewards.

For developers, Mode implementation:

The airdrop reward for developers is 500 million tokens, accounting for 5% of the total token supply. Airdrops for developers are not relevant to most users, so no detailed explanation will be given.

The specific interaction process for ordinary users is as follows:

1 . Check in to the airdrop activity page (https://ref.mode.network/MDCKN9) to check the initial points. If you cannot see the points, "INELIGIBLE TO CLAIM" is displayed, indicating that the user is on a restricted IP and needs to be changed.

2. Bridging assets, users Points need to be activated from other network bridging assets, and ETH is required as gas fee for the airdrop event. You can use official bridges or third-party bridges to bridge assets. Using official bridges can only bridge assets from the main network, which will incur higher gas fees, and there is a seven-day waiting period for asset reflection when withdrawing. You can also choose MiniBridge (https:/ /minibridge.chaineye.tools/) and other third-party cross-chain bridges can connect assets from other layer 2 bridges to Mode, resulting in relatively low bridging fees.

The community manager stated that the official bridge needs to be used at least once. It is recommended to use the official bridge first, and then use the third-party bridge.

3. Interactive applications. Users can interact with applications on Mode to obtain points. Different applications can obtain different points. In addition, Mode has also cooperated with lrt projects ether.fi and renzo. lrt projects have relatively high TVL and funds. The amount is sufficient, which is conducive to improving the TVL of Layer 2.

Share the "one fish, two eats" strategy, you can bridge weETH tokens and ezETH to Mode, and you can get staking income, Eigenlayer points, lrt at the same time Agreement points and Mode points are helpful to improve the utilization rate of funds.

03 Analysis of various dimensions of the project

Team background strong>

James Ross:Founder of Mode Network. Graduated from the University of Sussex in the UK, majoring in economics and philosophy. He invested in eigenlayer and ethena, and worked as a consultant at Hashflow.

Federico Sarquis: Technical Director of Mode Network. Previously organized events for Ethereum Argentina.

In terms of team, Mode LinkedIn page has a total of 15 employees, but its core employees are not many. It seems they may be working remotely. Founder James Ross can invest in eigenlayer and ethena, and his industry connections should be good.

Technical level

< /p>

Mode is a modular Layer2 network based on OP Stack. The Layer3 network Mode Flare supported by Optimism and Celestia is currently online and is suitable for the development of on-chain games and trading platforms. . In terms of technology, in addition to the concept of "modularity", you also need to understand OP Stack and Mode Flare.

1, modular blockchain

Modular blockchain is one that focuses on processing a small number of jobs and outsources the rest to one or more independent layers.

The purpose of modularization is to solve the impossible triangle of blockchain, namely security, decentralization and scalability. This theory is developed by Ethereum It was proposed by founder Vitalik and is considered one of the standards for testing public chain projects.

We can see the three most well-known projects in the public chain track, Bitcoin, Ethereum, and Solana, and their focus in the impossible triangle of blockchain. It's different. Bitcoin has the strongest security and decentralization in the blockchain industry, but its scalability is almost zero. Solana is definitely the least secure and decentralized, but has the best scalability of the three.

Modularization mainly divides the consensus layer, execution layer, and data availability layer into different chains, such as settlement on Ethereum, and using Celestia for data availability. , and then use SVM to execute in Solana. Through hierarchical dissociation, different requirements can be implemented on different blockchains to minimize the impact of the "blockchain impossible triangle".

Layer 2 that adopts modularization includes Mantle, Eclipse, Boba Network, etc. These projects are actually somewhat different from the head projects of Layer 2, but they all adopt modularization. Won some new development opportunities.

It can be said that modularization is one of the important narratives of this bull market.

2, Op Stacks

Stack service launched by Layer2 head project Optimism. Many well-known projects have adopted Op Stacks, such as Layer2 Base developed by Coinbase, Debank Chain developed by asset management application Debank, and Farcaster, a leading social protocol. Developed by Farcaster Stack. Op Stack has been used in projects in many fields, which is more in line with the Op super chain concept when Op Stack was first launched.

Op super chain refers to the decentralized Layer2 forming a network. In this network, all Layer2 share security, communication layer and open source technology Stack. Chains must conform to specific standards to enhance interoperability between chains. Layer 2 projects using Op Stack services should generally be considered a member of the Op super chain.

According to L2beat data, as of March 10, 2024, the top five projects in Layer2 TVL are Arbitrum, OP Mainnet, Blast, Manta Pacific and Starknet. Optimism ranks 29th in the cryptocurrency market capitalization ranking, and Arbitrum ranks 47th. Its TVL ranking does not correspond to the token market capitalization ranking. The key reason is that Optimism’s Stack service is used by many projects, while Arbitrum does not. , this is the narrative value brought by Stack services. Therefore, joining the Op super chain should be beneficial to the development of the project at present.

3, Mode Flare

The Layer 3 network powered by Optimism and Celestia is designed for developers to deploy application chains. It has the characteristics of high throughput, rapid deployment, EVM compatibility, flexible technology stack, etc., and the transaction fee is less than US$0.005 . There are currently three projects ready to be launched on Mode Flare, namely:

1) DEDPRZ, a cryptocurrency casino built using $USA tokens and DEDPRZ NFT

2) Liq Market, a decentralized derivatives exchange

3) Macaw, for political events Or a prediction market for betting on news and current events

There have been some Layer 2 projects that have launched Layer 3 projects before, such as Arbitrum’s Xai. These Layer 3 projects are mainly for cheaper gas fees. It is designed with higher throughput and is aimed at game tracks with high interactive characteristics. Its application value is somewhat inferior to Layer 2, but as a development direction, its upper limit is not low.

Mode Ecosystem

Next, let’s sort out some of the ecological projects that are currently online in Mode.

Ether.fi is a liquidity re-pledge protocol based on the Ethereum mainnet in the Eigenlayer ecosystem, allowing users to transfer ETH or other Liquidity remortgage tokens are remortgaged to generate lrt tokens and receive eETH at a 1:1 ratio.

Ether.fi is the leading protocol in the liquidity re-staking field, with a TVL of US$2.67 billion and a two-round financing amount of US$32.3 million. The investors include CoinFund , North Island Ventures, OKX Ventures, etc.

Renzo is a liquidity re-pledge protocol based on the Ethereum mainnet in the Eigenlayer ecosystem. Users can put eth or other liquidity Remortgage tokens to generate lrt tokens and obtain ezETH at a 1:1 ratio. Renzo ranks third in the liquidity re-hypothecation track. The first is Ether.fi and the second is Puffer Finance, with a TVL of US$990 million. The seed round raised US$3.2 million, with investors including Binance Labs, OKX Ventures, IOSG Ventures, Robot Ventures and other well-known institutions.

Kim Exchange is a decentralized exchange native to Mode, driven by the community, providing customizable protocols, sorted by Mode The server fee sharing mechanism provides users with greater incentives, with a TVL of US$6.45 million.

IONIC is a lending protocol on Mode, powered by Metacartel Ventures, Ohm and Mode. Ionic aims to provide the best interest rate on Mode and has designed a targeted economic model that is conducive to balancing the interests of borrowers and lenders, with a TVL of $61 million. The founder is Henri Mahal, and the investor is MetaCartel Ventures.

Mode Name Service is a domain name service provided by Space ID. The domain name format is .MODE, as of March 10, 2024 , a total of 75.7k domain names were registered, with a total of 70.3k holders.

LogX is a perpetual contract exchange that trades with Bitcoin and Ethereum and is designed as a large-scale aggregator , bringing together liquidity from different chains. Users do not need to manage gas fee tokens or perform multiple transactions for each operation, and the TVL is $11.21 million.

Poolshark is a decentralized protocol for directional liquidity. It has been launched on Layer 2 of Mode, Arbitrum and Scroll. , through directed liquidity, pool depositors can create sell-only liquidity positions. Poolshark can provide limit order trading on dex for professional traders, with a TVL of $595,000.

Layerbank is a full-chain lending agreement covering LSD, RWA, LRT and other fields. It is currently available in Manta, Bsquared , Mode, Linea and Scroll and other Layer2 are online, with a total of US$414 million, of which the TVL on Mode is US$10.11 million.

Generally speaking, Mode’s ecology is dominated by Defi projects, which has relatively interactive value. Mode is currently working on cooperating with liquidity re-pledge projects, which is beneficial to both parties - Mode can acquire more users and funds, and the tokens of liquidity re-pledge projects also have more usage scenarios.

04 Modular Layer2 competitive landscape

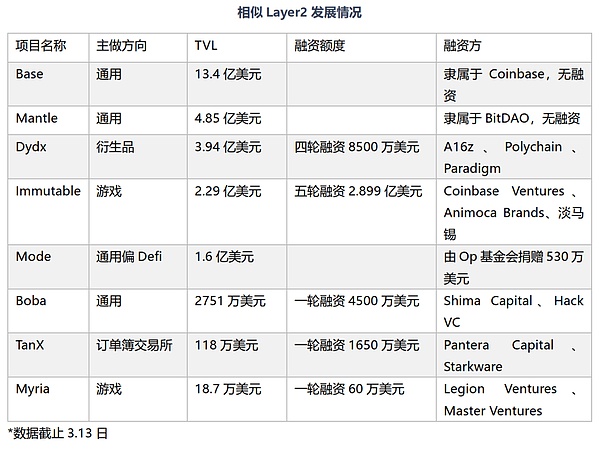

Mode is a modular Layer2 that uses Op Stack services, so choose others that use Stack services or Modular Layer2 is used as the comparison object.

05 Summary

Mode is a modular Layer 2 project that uses Op Stack and focuses on the Defi track. The Op super chain created by Op Stack has many well-known projects settled in it, which is conducive to attracting users and expanding the ecosystem. At the same time, modularity is one of the key narratives of this bull market. The improvement of public chain performance cannot simply rely on the same public chain. Modularization can help bring out the advantages of each public chain. Therefore, modular leading projects have performed well.

Generally speaking, Mode is more in line with Layer2’s current development path, and its project results are worth looking forward to. From the perspective of the competitive landscape, Mode has performed relatively well among similar projects and is determined to become the DeFi Hub of op super chain. Its future development is worthy of attention.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Cheng Yuan

Cheng Yuan TheBlock

TheBlock Others

Others TheBlock

TheBlock Coinlive

Coinlive  链向资讯

链向资讯 Ftftx

Ftftx