Compiled by: Golden Finance; Source: Binance, Golden Finance

On April 12, 2024, Binance issued an announcement stating that Binance will list Omni Network (OMNI) at 20:00 (Eastern Time Zone 8) on April 17, 2024, and open OMNI/BTC, OMNI/USDT, OMNI/BNB, OMNI/FDUSD and OMNI/TRY trading markets, subject to seed label trading rules.

1. Project Details

Token Name:Omni Network (OMNI)

Maximum Token Supply:100,000,000 OMNI

Initial Circulation:10,391,492 OMNI (10.39% of the maximum token supply)

Total Mining:3,500,000 OMNI (3.5% of the maximum token supply)

Research Report:Omni Network (OMNI) (Research Report will be online within one hour of this announcement)

Smart Contract Details: Ethereum

Restrictions:KYC required

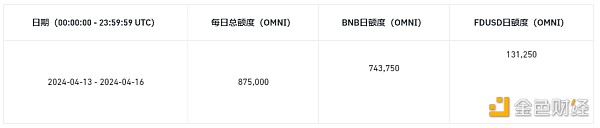

Individual hourly mining hard cap:

BNB mining pool: 3,098.95 OMNI

FDUSD mining pool: 546.87 OMNI

Mining pool:

BNB mining pool (the website will be updated within five hours of this announcement, before the mining activity opens): A total of 2,975,000 OMNI (accounting for 85%) can be mined

FDUSD mining pool (the website will be updated within five hours of this announcement, before the mining activity opens): A total of 525,000 OMNI can be mined OMNI (15%)

Mining time: 08:00 on April 13, 2024 to 07:59 on April 17, 2024, Eastern Time

Mining quota phase allocation

2. Understanding Omni Network (OMNI)

Omni is Ethereum's integrated Rollup layer, allowing developers to build unified applications across all Ethereum scaling solutions. It is powered by a novel blockchain architecture that supports sub-second finality and obtains security from Ethereum through re-staking.

Omni is building an Ethereum interoperability layer, leveraging the EigenLayer stack to enable Rollups to communicate with each other efficiently. Currently, the industry is plagued by the high costs and slow confirmation times of Layer 1 blockchains. Rollups offer solutions to these problems, but are currently very isolated and fragmented. As the founders of Omni put it, Omni is built as a unified whole that will "create a new path forward for Ethereum's modular future."

Omni's network uses validators to re-stake ETH, which then forms the security foundation of the network, creating a new security standard between modular blockchains. Omni plans to open source this technology so that other chains can use it for custom development and ensure strong interoperability. The protocol combines the re-staking mechanism with Tendermint PoS consensus to reach consensus on the state of the Rollup in an extremely fast way, thus acting as a settlement layer for the Rollup. Tendermint guarantees Omni's speed, while the re-staking mechanism provides Omni with a stronger level of security. Because Omni's execution layer is compatible with the EVM, developers can build native cross-Rollup applications - a major step forward in interoperability. In addition, developers can develop in Solidity and take advantage of built-in functions to access states, messages, and applications from other Rollups. By gaining security from Ethereum/EigenLayer and using Tendermint to implement cross-Rollup functions, Omni is expected to become the future of interoperability for Ethereum and other networks.

Omni has established partnerships with leading Rollups such as Arbitrum, Polygon zkEVM, Starkware, Scroll, and Linea.

Three, Omni's main innovations

Omni is an Ethereum native interoperability protocol that establishes low-latency communication between all Ethereum Rollups, enabling Ethereum to operate as a highly cohesive system in the era of modularity. Omni is developed by a team with extensive industry experience, and its goal is to unify Ethereum's fragmented Rollup ecosystem with the following significant features.

(1) Security

Interoperability protocols have always struggled with security challenges. First-generation protocols relied solely on a set of trusted participants who validated and relayed messages across the network. Over the years, these protocols have been home to numerous vulnerabilities, with cumulative losses exceeding $1 billion.

Second-generation protocols improved on this design by applying cryptoeconomic security to the network. Under this approach, participants stake the protocol’s native assets to participate in the validation process, which is a step in the right direction, but reliance on native assets makes the protocol’s security guarantees less stable.

Using EigenLayer, Omni introduces a completely new security model for interoperability protocols. Omni uses re-staked ETH to secure its validator set, allowing the protocol’s security to scale with Ethereum L1’s security budget. Ethereum’s current security budget exceeds $100 billion, an order of magnitude larger than any other PoS network. By leveraging re-staked ETH, a highly liquid, low-volatility asset, Omni’s security is more stable than its predecessor. Additionally, by sourcing security from Ethereum, Omni aligns its security foundation with the Rollups it connects to, enabling a security model that grows in tandem with the Ethereum modular ecosystem.

Omni is setting the standard for action with EigenLyer’s Active Validation Service (AVS). Omni became the first protocol to reach an agreement with a Liquidity Restaking (LRT) provider, agreeing to lease $600 million worth of restaking ETH from EtherFi. The Omni team has reached agreements with multiple other LRT providers, pushing its first-day security budget to over $1 billion. This will allow Omni to offer industry-leading security at launch without the protocol incurring excessive network startup costs. As the only Active Validation Service (AVS) running on a testnet besides EigenDA, Omni is positioned as the most production-ready AVS on the market.

(2) Sub-second Validation

One of the key advantages of integrated blockchains like Solana over modular systems is low latency transactions. Users are becoming accustomed to sub-second transaction times, reflecting the superior user experience of today’s cloud-based web applications. For Ethereum to compete with these alternative platforms, cross-Rollup message latency must be comparable to the transaction speed of the integrated system.

Omni brings this experience to Ethereum Rollup using a novel protocol architecture that enables sub-second cross-Rollup message verification. After processing 7.5 million transactions from 550,000 wallets on the previous test network, Omni Labs completely overhauled the network architecture. The core component of the design is Octane, a new open source framework that combines the EVM with CometBFT consensus. Octane uses the Ethereum Engine API and ABCI++ to create a clear separation between the execution and consensus environments of the Omni node, thereby isolating the component bottlenecks in the existing EVM<> CometBFT architecture.

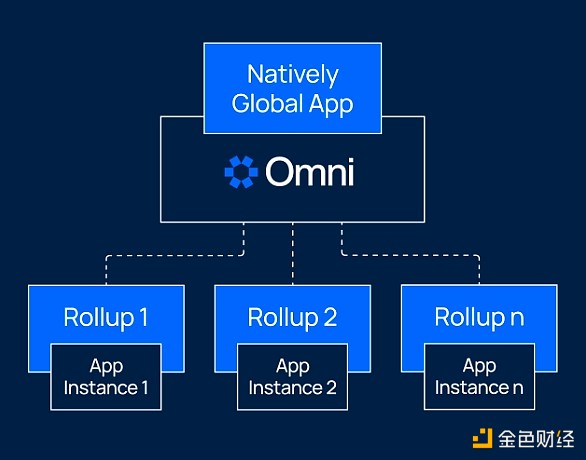

(3) Native Global Applications (NGAs)

In addition to providing cross-Rollup message verification, Omni also provides a dedicated execution environment, Omni EVM, which allows developers to manage all rollup application deployments in one place. Using Omni EVM as a coordination layer, developers can deploy native global applications (NGAs). NGAs are a new class of applications that can dynamically propagate contracts and interfaces to any Rollup, enabling them to access all liquidity and users of Ethereum by default. With NGAs, developers can take advantage of the scalability of Ethereum Rollup without having to manage distributed state between multiple Rollup environments.

As the Rollup ecosystem continues to grow, projects will develop more custom Rollup solutions, each tailored to specific functional and performance requirements and using unique virtual machines, programming languages, and data availability architectures. Omni is intentionally designed to support any Rollup architecture, enabling seamless application management through the Omni EVM.

(4)Backward compatibility

In order to accommodate existing Rollup applications, Omni is designed with backward compatibility in mind. Applications can integrate Omni without modifying deployed contracts. Applications use modified front-end instructions to aggregate cross-Rollup messages, allowing Omni to act as a wrapper for existing application deployments. Omni also introduces a universal gas market for delivering cross-Rollup messages to the target network, eliminating the need for users to maintain different gas tokens.

IV. Technical Infrastructure

(1)Modular node architecture:

Omni introduces a new node architecture (Octane) designed around the Ethereum engine API. This creates a clear separation between the consensus and execution environments of each node, while allowing nodes to use existing Ethereum execution clients.

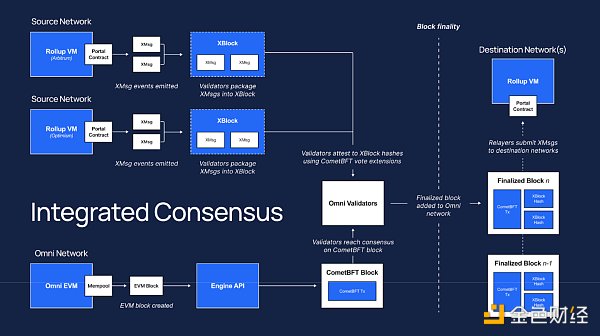

(2)Integrated consensus:

Omni validators use CometBFT consensus and ABCI++ voting extensions to simultaneously verify cross-Rollup messages and transactions on the Omni EVM.

(3)Native Global Applications:

Omni EVM simplifies cross-Rollup application development by dynamically propagating contracts and interfaces to any Rollup. This approach to building cross-Rollup applications allows developers to program cross-Rollup applications in a single environment and minimizes the possibility of smart contract vulnerabilities arising from the complexity of handling distributed states.

V. Token Sale and Economics

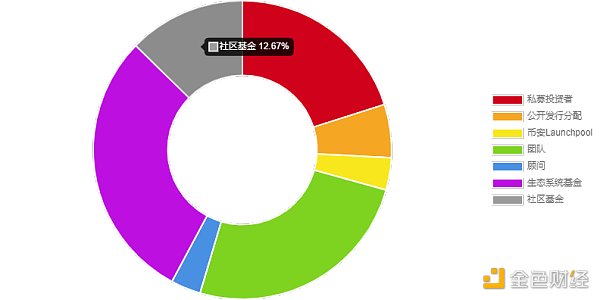

(1) Token Distribution

(2) Token Issuance Schedule

title="7208778" alt="AU6VJuWNPQKO4n7GJgKjDtcGN5BnDa1oRJK9ffdM.png">VI. Roadmap and Updates

(1) Completed Milestones

2022: Omni completed an $18 million financing led by Pantera Capital.

2023Q2: Omni Network quietly emerged and released the first technical architecture document.

2023Q3: Testnet 1: Omni Origins has been completed.

2023Q4: Testnet 2: Omni Overdrive has been completed.

2024Q1: Omni becomes the first AVS to provide over $1B in economic security through top liquidity re-collateralization protocols including Ether.fi, KelpDAO, and Swell. Open Liquidity Network Launched; Final Testnet: Omni Omega Launched; Omni Whitepaper Released.

(2) Current Roadmap

Q2 2024:

Q3 2024:

Batch launch of Native Global Applications (NGAs) deployed on Omni EVM.

Multi-Rollup declarative deployment for smart contracts, facilitating a Kubernetes-like developer experience for scaling applications across all Rollups.

Typescript frontend library for deploying native multi-Rollup applications that work seamlessly across all Rollups.

Q4 2024:

Expand Omni Network to include alternative data availability systems like EigenDA and Celestia.

Proof of Sharding to increase the network’s Rollup capacity by an order of magnitude.

Join MPC Providers to provide institutional users with access to all Ethereum Rollups.

VII. Commercial and Business Development Progress

(1) Ethereum L2:

Examples:Arbitrum, Optimism, Polygon, Linea, Scroll, zkSync, Mantle, Metis, Base, Plume, etc.

Definition:Layer 2 blockchain extends the Ethereum network.

Scope:Natively integrated to ensure access to the expanding L2 ecosystem across Ethereum.

(2)Liquidity Re-injection Protocols:

Examples:EtherFi, Renzo, Puffer, Swell, Kelp, EigenPie, Bedrock, etc.

Definition:Liquidity re-staking protocols are liquidity derivatives platforms built on EigenLayer. They act as interfaces to the EigenLayer ecosystem by securing Active Validation Services (AVS) such as Omni and provide users with higher returns than ETH staking.

Scope:Omni has received Ethereum commitments totaling over $1 billion to secure the Omni network from the leading re-staking protocols listed above.

(3)EigenLayer:

Definition:EigenLayer is an Ethereum-based protocol that introduces restaking, a new primitive in cryptoeconomic security. This primitive allows ETH to be reused on the consensus layer. Users who natively stake ETH or use Liquid Staked Tokens (LST) can opt-in to the EigenLayer smart contract to restake their ETH or LST and extend cryptoeconomic security to other applications on the network to receive additional rewards.

Scope:Omni Network is a blockchain secured by restaking enabled by EigenLayer. Over 50,000 individual stakers have delegated Ethereum to secure Omni through the Eigen Layer on testnet.

(4)Rollup as a Service Provider:

Examples:Conduit, Caldera, Ankr, AltLayer.

Definition:RaaS providers allow anyone to deploy Rollups. They provide an all-in-one infrastructure that enables customers to quickly deploy on the Ethereum mainnet.

Scope:Native components in a RaaS product package that provide immediate, out-of-the-box interoperability for any developer using a RaaS provider.

(5)Infrastructure Partners:

Examples: a41, Galaxy, Blockdaemon, Kiln, Ankr, etc.

Definition:Core infrastructure partners that provide validator, node, and operator services for Omni.

Scope:The Omni Infrastructure Partners listed above have committed to protecting the security of the Omni Network by accepting delegations from Omni stakers and Ethereum re-staking.

Eight, Summary

The adoption of a Rollup-centric roadmap has been committed to scaling across isolated execution environments. While this approach is actively addressing the network's scalability challenges, it has fragmented capital, users, and developers across a growing number of Rollups. To address these issues, Omni was born, an Ethereum-native interoperability protocol that establishes low-latency communications in Ethereum's Rollup ecosystem.

Omni creates a new design framework that prioritizes security as the foundation of the protocol. Through re-staking, Omni obtains cryptoeconomic security from Ethereum L1 and uses it to protect its externally verified network architecture. The integration of a double staking model further strengthens this security architecture and positions Omni as a new benchmark for secure interoperability.

With a strong security framework in place, Omni designers turned their attention to optimizing Omni's performance. The team's goal is to implement a consensus mechanism that can handle cross-Rollup communications with minimal latency. By developing a unique protocol architecture, combining technologies such as CometBFT, ABCI++, and Engine API, the Omni validator achieves this goal by providing sub-second validation for cross-Rollup messages.

In terms of global compatibility, Omni is intentionally designed with minimal integration requirements to make it compatible with any Rollup architecture and application design. The introduction of a universal Gas market simplifies the user experience for cross-network applications, while the addition of the Omni EVM provides developers with a global platform for deploying and managing cross-network applications.

Omni represents a comprehensive interoperability solution for Ethereum Rollups and is poised to re-unify the Ethereum ecosystem. With Omni, Ethereum can once again provide a single, unified operating system for decentralized applications.

Cheng Yuan

Cheng Yuan

Cheng Yuan

Cheng Yuan Hui Xin

Hui Xin Alex

Alex Alex

Alex CryptoSlate

CryptoSlate Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist