Source: Blockchain Knight

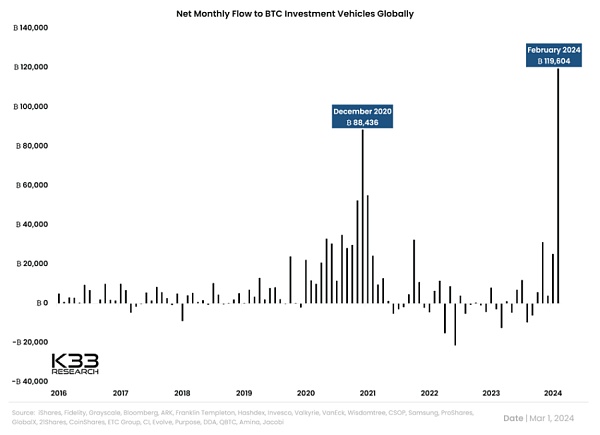

At the beginning of this year, the price of BTC soared by nearly 50%, mainly due to the launch of the BTC ETF. These ETFs greatly facilitate retail and institutional investors’ exposure to this leading Crypto asset.

The recent price action has also sparked discussion among industry leaders as to why institutional investors are increasingly attracted to the Crypto asset market.

In a recent interview, Chainlink founder Sergey Nazarov pointed out that the new investors pouring into BTC come from the global financial system and they are looking forward to the next evolution of the Crypto asset field, which is " Real-world asset tokenization.”

Nazarov emphasized thatmajor financial institutions are preparing for asset tokenization, aiming to compete with or take advantage of the funds flowing into ETFs.

Nazarov also said: “The next stage in the Crypto asset field is asset tokenization. When banks see all these funds flowing into ETFs, they will create assets to compete with ETFs, or acquire Some of these funds."

Tokenization is the conversion of asset rights into digital tokens on the blockchain. This process is expected to improve the liquidity, transparency and efficiency of digital physical assets.

McKinsey cited predictions from industry experts that the trading volume of tokenized digital securities may reach US$5 trillion by 2030.

Similarly, BlackRock CEO Larry Fink believes that tokenization is a major technological breakthrough that has the potential to change asset management.

Fink explained: “We already have tokenization technology today. If you have a tokenized security and identity, the moment you buy or sell the instrument on the ledger, Everything will be created together."

"In addition, regarding financial illegal issues, if there is a tokenized system, all corruption can be eliminated."

US presidential candidate Robert Kennedy Jr. believes that another important factor driving institutional interest in BTC is that BTC is considered to have a hedge against inflation.

Kennedy pointed out that BTC’s recent price performance further enhances its credibility as a “refuge” from the central bank’s tendency to print money. Kennedy also emphasized the significance of BTC to the freedom of transactions, likening it to freedom of speech.

Kennedy explained: “We need to make sure that people who want to protect themselves from inflation can own BTC. We also need to make sure that they have the freedom to trade. The government can’t use our currency like Canada does. Digital.”

Galaxy Digital CEO Mike Novogratz believes that BTC’s growth potential will continue to attract “a new army of buyers.”

Novogratz believes that the baby boomers (people born during a period when the birth rate increased significantly) who control $85 trillion in global wealth can enter the BTC market through the recently launched BTC ETF. He suggested that more than half of all registered investment advisers (RIAs) work together to promote this process.

Novogratz also believes that BTC’s market value may one day exceed gold.

Novogratz’s prediction is based on younger generations, especially Generation Z and Millennials, who prefer BTC to traditional assets such as gold.

Miyuki

Miyuki

Miyuki

Miyuki Zoey

Zoey JinseFinance

JinseFinance cryptopotato

cryptopotato dailyhodl

dailyhodl cryptopotato

cryptopotato Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph